The Capital Stack & The Concrete Slab: Orchestrating the Billion-Dollar Symphony of Property Development

The skyline of any great city is not a product of chance, but the result of deliberate and often audacious vision. Behind every towering skyscraper, every sprawling residential community, and every thriving commercial center stands a highly specialized figure: the real estate developer. This individual, or firm, is the ultimate orchestrator, the catalyst who initiates, coordinates, and executes the immensely complex process of converting a concept on paper into tangible, profitable, and functional real property. They are, in essence, the architects of our built environment, wielding the power to shape the way we live, work, and interact.

From Blueprint to Reality: The Developer’s Value Proposition

The concept of a real estate developer is often simplified, but their role is far more profound than simply buying land and hiring a contractor. They are the entrepreneurs of the property world, taking on the greatest risk for the potential of the greatest reward. They identify a need in the market—for housing, office space, retail, or industrial capacity—and then assemble a vast, specialized team to fulfill that need. The developer’s value lies in their ability to synthesize disparate elements—financing, design, legal regulation, construction, and marketing—into a cohesive and successful project. They don’t just build buildings; they create value from raw potential, ensuring the economic viability and long-term sustainability of every structure and community they conceive.

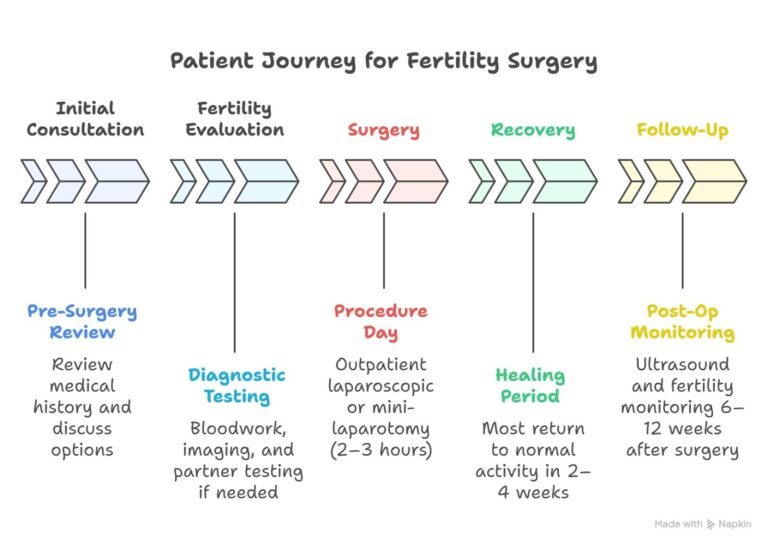

The Development Cycle: A Symphony of Stages

The journey of a real estate development project is a multi-phased endeavor, demanding foresight, financial acumen, and an unparalleled ability to manage risk. This process can be broken down into several distinct, yet interconnected, stages.

- Acquisition and Site Control: The process begins with identifying and securing a suitable tract of land. This involves intensive market analysis to confirm the site’s potential for the desired use, followed by securing site control through purchase, lease, or an option agreement. Due diligence in this phase is paramount, covering everything from title searches to environmental assessments.

- Feasibility and Conception: Once the land is controlled, the developer must conduct a comprehensive feasibility study. This detailed analysis determines if the project is both physically possible and financially viable. It includes a market analysis to forecast demand, a site analysis to assess physical constraints, and a financial pro forma to project costs, revenues, and return on investment. The initial design program is developed here, outlining the size, scale, and intended use of the property.

- Design, Planning, and Approvals: This is the creative and regulatory bottleneck phase. The developer leads a team of architects, civil engineers, and landscape architects to create detailed design plans. Simultaneously, they must navigate the labyrinthine world of zoning regulations, building codes, and municipal approvals. Obtaining the necessary entitlements—variances, permits, and zoning changes—is often the most time-consuming and politically sensitive part of the process. For those focused on complex, high-density markets like the northeast, understanding regional specifics is critical. A dedicated real estate developer often maintains a specialized focus, for instance, on locations like New York, due to the unique regulatory and political environment.

- Financing and Capital Structuring: Arguably the developer’s most critical function is structuring the capital stack. Projects are rarely funded solely by the developer’s equity. They must secure a mix of debt (traditional bank loans, construction loans, hard money) and equity (private investors, joint ventures, or institutional capital). The financial structure must be robust enough to weather inevitable cost overruns and delays.

Navigating the Capital Stack: Funding the Vision

Securing the right blend of financing is a high-stakes endeavor that separates successful developers from the rest. The capital stack is a layered structure of funding sources, each with its own risk profile and expected return.

- Senior Debt: This is the lowest-risk layer, typically provided by banks or institutional lenders. It holds the first lien on the property, meaning it is repaid before all other debts.

- Mezzanine Debt: A higher-risk loan that sits between senior debt and equity. It is often structured as a loan that converts to equity if the developer defaults, offering a higher return to the lender.

- Preferred Equity: This is a non-voting ownership stake that has preference over common equity in receiving distributions. It is essentially the last debt layer before the developer’s own money.

- Common Equity: This is the developer’s own investment and the capital raised from their partners. It absorbs the first losses but receives the greatest potential profits.

The developer must possess an astute understanding of current market interest rates, loan-to-value ratios, and investor expectations to craft a financial package that works for all parties involved. A misstep in this phase can doom a project before the first shovel hits the dirt.

Construction and Project Management: Bridging Theory and Practice

Once financing and permits are secured, the construction phase commences. The developer transitions into a high-level project manager, responsible for ensuring that the building is constructed on time, on budget, and to the required quality standard.

Key responsibilities during construction include:

- Selecting and managing the general contractor and subcontractors.

- Implementing strict cost control and tracking change orders.

- Overseeing compliance with all safety and environmental regulations.

- Managing the flow of funds (draws) from the lender to the construction team.

The Modern Frontier: Challenges and Innovation

The role of the developer is perpetually evolving, shaped by global economic shifts, technological advancements, and a growing emphasis on sustainability.

One of the most persistent and significant challenges is navigating regulatory and zoning changes. Municipal laws are constantly in flux, and a developer’s proposed project, even one that aligns with current laws, can face unexpected delays or modifications due to new legislation or community opposition. A deep engagement with local government and a commitment to transparency with the community are essential mitigation strategies.

Furthermore, the industry is grappling with supply chain disruptions and rising construction costs. The prolonged lead times for essential materials, such as HVAC systems and electrical components, force developers to implement sophisticated pre-ordering and logistics strategies to keep projects on track.

The future of development is increasingly centered on PropTech (Property Technology) and sustainability. Developers are integrating smart building technologies, from advanced energy management systems to AI-driven security platforms, to create more efficient and appealing properties. There is also a powerful industry-wide pivot toward Environmental, Social, and Governance (ESG) criteria. This involves:

- Designing for net-zero energy consumption.

- Using sustainable and locally sourced materials.

- Prioritizing human-centric design, focusing on occupant health and well-being.

- Committing to affordable housing components within larger market-rate developments.

This push toward sustainability is not merely altruistic; it is an economic necessity. Energy-efficient buildings command higher rents, retain tenants longer, and are increasingly prefer by institutional investors.

Conclusion

The real estate developer is the quintessential entrepreneur, a unique blend of visionary, financier, risk manager, and community builder. They take on the enormous task of transforming raw resources and capital into the physical structures that define our society. Their work is a delicate balance of speculative risk and meticulous execution, requiring them to constantly adapt to economic volatility, navigate complex regulations, and integrate the latest innovations in sustainable design and technology. The success of a developer is measure not just in profits, but in the enduring quality and positive impact of the communities and properties they bring to life. They are, quite literally, building the future.

Frequently Asked Questions (FAQs)

What is the core difference between a real estate developer and a general contractor?

A general contractor is responsible for the physical construction of the building according to the approved plans, managing the tradespeople, and adhering to the construction schedule and budget. The real estate developer is the project initiator and financier; they conceive the project, acquire the land, secure the financing, hire the general contractor, oversee the design and permitting, and ultimately market or sell the finished product. The developer is the CEO of the entire project, while the contractor is the head of production.

How does a developer make a profit?

A developer typically makes a profit in one of two ways:

- Development Fee: Charging a percentage fee on the total project cost.

- Residual Profit: Selling the completed asset for a price higher than the total development cost (land, soft costs, construction, and financing). Retaining the asset and generating profit through long-term rental income and property appreciation.

What is a “capital stack” in real estate development?

The capital stack is the structure of all the debt and equity financing used to fund a project. It is layer, with the least risky financing (senior debt). The bottom and the highest-risk/highest-return financing (common equity) at the top. The structure determines the priority of repayment for all investors and lenders.

What are ‘soft costs’ versus ‘hard costs’ in development?

- Hard Costs are the direct, tangible costs of construction, including materials, labor, and site work.

- Soft Costs are the indirect, non-construction costs, such as architectural and engineering fees, legal and accounting fees, permit costs, property taxes, insurance, and financing costs (loan interest).